maximum loanable amount in sss|SSS Salary Loan: Requirements and Process Guide : iloilo Learn how to apply for a salary loan from SSS, which is equivalent to one or two months of your latest posted monthly salary credits. Find out the interest rate, repayment period, .

Named St. Louis’s Best Marketing Firm Nine Years in a Row. Think Tank PR + Marketing + Design is an award-winning marketing and advertising agency that strives to deliver exceptional results by implementing the extraordinary. We provide innovative marketing and public relations plans that get clear results for our clients.

maximum loanable amount in sss,Learn about the SSS salary loan, a cash loan granted to SSS members based on their contributions. Find out the maximum loanable amount, the requirements, the application process, and the FAQs. Tingnan ang higit paIn a nutshell, SSS salary loan is a cash loan that SSS members, whether employed or self-employed/voluntary, can use to meet their short-term needs. Due to the fast approval process and low . Tingnan ang higit pa

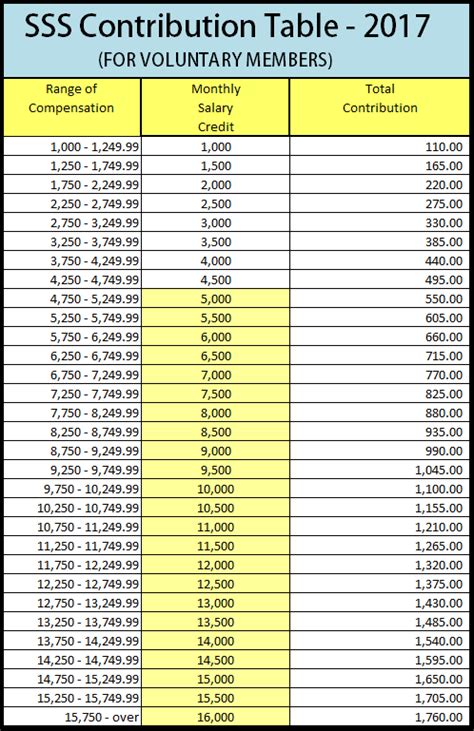

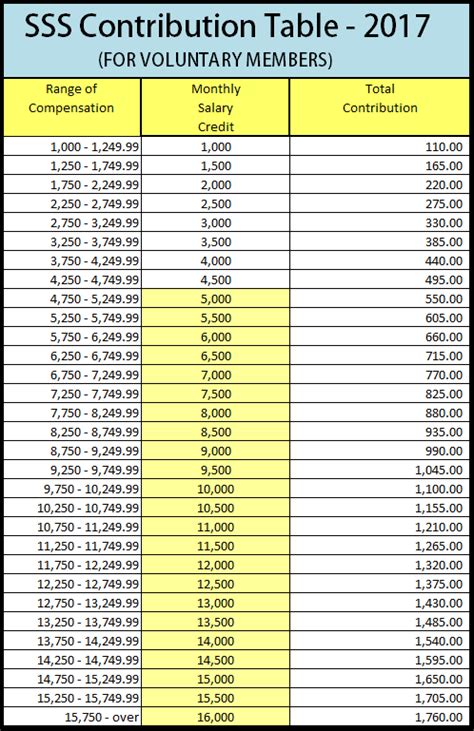

To avail of the salary loan, the SSS member must meet the following eligibility requirements: 1. Must be under 65 years oldat the time of application; 2. Must be a regular paying SSS member . Tingnan ang higit pamaximum loanable amount in sss SSS Salary Loan: Requirements and Process GuideMembers who have paid 36 monthly contributions are qualified to avail of the one-month salary loan equivalent to the average of the member’s 12 latest posted Monthly Salary Credits (MSCs), rounded to the subsequent higher MSC, or the amount the member applied for, whichever is lower. Since the maximum Monthly Salary . Tingnan ang higit pa

Per the SSS Circular 2019-0142, member-borrowers who want the SSS salary loan must now apply online. To complete the SSS salary loan application, you need the following: 1. Internet connection; 2. My.SSS account. If you haven’t registered and created an account yet, please follow this step-by-step guide; 3. Preferred . Tingnan ang higit paLearn how to apply for a salary loan from SSS, which is equivalent to one or two months of your latest posted monthly salary credits. Find out the interest rate, repayment period, . The minimum and maximum amounts that you can borrow actually depends on the total monthly contributions you have posted. You can refer to the table below: If .QUALIFYING CONDITIONS. An employed member or a currently-paying self-employed or voluntary member. For one-month loan: 36 monthly contributions, six (6) of which .The maximum loanable amount for housing loan for repairs and/or improvements is P1,000,000.00, based on appraised value of collateral, borrower's capacity to pay, and . How much can I borrow? And how much is the first loan of SSS? Find the answers to such questions, as well as the eligibility requirements below. ☑️ Up-to-date Monthly SSS Contributions and .Example of a Loan Calculation: Assume your MSC, based on the SSS table, is PHP 15,000. For a one-month loan: PHP 15,000 (average MSC) x 1 = PHP 15,000. For a two . According to SSS, to avail a one-month loan, the applicant must have posted at least 36 monthly contributions prior to the month of application. With regards to the two-month loan, the applicant should . With regards to the SSS Salary Loan loanable amounts this 2024, the borrowing amount allowed by the state-run social insurance giant depends on the .

With regards to the SSS Salary Loan loanable amounts this 2024, the borrowing amount allowed by the state-run social insurance giant depends on the .The Social Security System (SSS) disbursed over P115.53 million for educational loans from January to June 2021, 52.5 percent or P39.75 million higher than last year?s releases. . The maximum loanable amount for a degree course is P20,000.00 per semester/trimester/quarter or net tuition/miscellaneous fees/assessment balance on . 1. Open your Internet Browser and type www.sss.gov.ph in your URL. 2. Login using your User Name and Password. If you do not have an SSS Online Account yet, you may create one. Follow this step . The member may borrow a one-month or two-month salary loan. Here is a guide on the SSS Salary Loan loanable amounts 2024 based on the total contributions posted by the member-borrower: For members who have posted at least 36 monthly contributions but not more than 71 monthly contributions, the “one-month salary loan is .maximum loanable amount in sss However, if you have been paying ₱1,760 in the past 3 years, your maximum SSS salary loan is ₱16,000. This is the ceiling amount or the highest amount for 1 month salary loan. 2 Month Salary Loan Example: On the other hand, if you have been contributing ₱1,100 for the past 6 years, your highest loanable amount from SSS . For the SSS loanable amount under the salary loan offer, here is the explanation of the social insurance institution: A one-month loan is equivalent to the average of member’s last twelve (12) monthly salary credits (MSCs), or the amount applied for, whichever is lower. According to SSS, the amount granted will be charged to an .

SSS Loan Computation . You can borrow a maximum SSS Salary Loan amount of P15,000 for a one-month loan. The highest amount you can borrow for a two-month salary is P30,000. However, the actual loanable amount will depend on the average amount you have been paying as your monthly contribution for the last 12 months. SSS Salary Loan .The SSS Online Loan Calculator is a great tool to help you determine how much you can borrow from the Social Security System (SSS). This calculator takes into account your current monthly salary, age, and contribution history to provide you with an estimate of the maximum loanable amount. Simply enter your information into the calculator below .LOANABLE AMOUNT The loan amount that may be availed is based on the basic monthly pension (BMP) together with the PI ,000.00 (1 K) additional benefit. Dependent's pension, if any, is not included. The retiree-pensioner has the option to choose the loanable amount from any of the following, but not to exceed the maximum loan limit of P200,000.00. How much you may borrow under the SSS Cash Loan? The loanable amount actually depends on your monthly salary and contributions posted to the agency. If you have posted at least 12 monthly contributions, you may borrow an amount that is equivalent to your one-month salary. If your monthly contributions is at least 24, you may .

All currently employed, currently contributing self-employed or voluntary member. For a one-month loan, the member-borrower must have thirty six (36) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing of application.; For a two-month loan, the member-borrower must have seventy two (72) .SSS also extends financial assistance to its members whose houses were damaged or destroyed due to Typhoon Odette. Qualified SSS members may apply for the Direct House Repair and/or Improvement Loan. Under this, they can borrow a maximum loanable amount of up to P1 million. • To qualify, affected members must meet the following .

Example of a Loan Calculation: Assume your MSC, based on the SSS table, is PHP 15,000. For a one-month loan: PHP 15,000 (average MSC) x 1 = PHP 15,000. For a two-month loan: PHP 15,000 (average MSC) x 2 = PHP 30,000. These amounts are subject to the member’s actual need and the approval of SSS.

the following loanable amounts, but not to exceed the maximum loan limit of P32,000: 3.WHAT ARE THE STEPS IN APPLYING FOR A LOAN? A. The pensioner-borrower must go personally to any SSS branch or service office and present the original and submit a photocopy of any of the following: • Social Security (SS) ID card How much is the maximum amount you can borrow from SSS salary loans? That would depend on your salary, of course, and how much your monthly contributions are to SSS. . members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month .

The member may borrow a one-month or two-month salary loan. Here is a guide on the SSS Salary Loan loanable amounts 2024 based on the total contributions posted by the member-borrower: For members who have posted at least 36 monthly contributions but not more than 71 monthly contributions, the “one-month salary loan is .SSS Salary Loan: Requirements and Process Guide The maximum loanable amount for this SSS housing loan is ₱2 million. You can borrow up to ₱450,000 for the Socialized Housing Loan and up to ₱2 million for the Low-Cost Housing Loan. Like the Direct Housing Loan for WOMs, the approved SSS Housing Loan amount will depend on the borrower’s need, capacity to pay, and the .The maximum amount of a first-time loan from SSS is typically around Php 20,000. This may be lower or higher depending on your individual circumstances, so it’s important to check with the SSS before applying. So, this is the end of this article but we want you to recommend more things to learn, for example pag ibig salary loan, pag ibig loan .The maximum loan amounts from the Social Security System (SSS) in the Philippines depend on the loan type. For the Salary Loan, it’s based on your average monthly salary credit, capped at ₱30,000. The Calamity Loan offers a maximum of ₱20,000, and the Emergency Loan during economic crises can go up to ₱40,000.

maximum loanable amount in sss|SSS Salary Loan: Requirements and Process Guide

PH0 · SSS Salary Loan: Requirements and Process Guide

PH1 · SSS Salary Loan: Requirements and Process Guide

PH2 · SSS Salary Loan Loanable Amounts 2024 Based on Member’s

PH3 · SSS Salary Loan 2024: Requirements, Application Process, and More

PH4 · SSS Salary Loan 2024: Requirements, Application

PH5 · SSS Salary Cash Loan Minimum & Maximum Loanable Amounts

PH6 · SSS Online Loan Calculator

PH7 · SSS LOANABLE AMOUNT: How Much Is Loanable Under Salary Loan

PH8 · SSS LOANABLE AMOUNT: How Much Is Loanable

PH9 · SSS Cash Loan 2024 — Minimum and Maximum Loanable

PH10 · Republic of the Philippines Social Security System

PH11 · How To Compute SSS Salary Loan